1031 Exchange

1031 Exchange Service

Here at Q-1031, we offer 1031 accommodation service with a backup plan in case the deadlines are not met for your 1031 exchange. Our primary backup solution involves an Installment Sale Trust; however, we have more alternatives such as CRTs, DSTs, REITs, etc.

For more information regarding a 1031 Exchange and how to properly structure your next transaction, please contact at +1 844-636-6312 . Discuss the option of an Installment Sale Trust with one of our financial advisors to ensure you have a robust backup plan in place.

How a 1031 Exchange Works

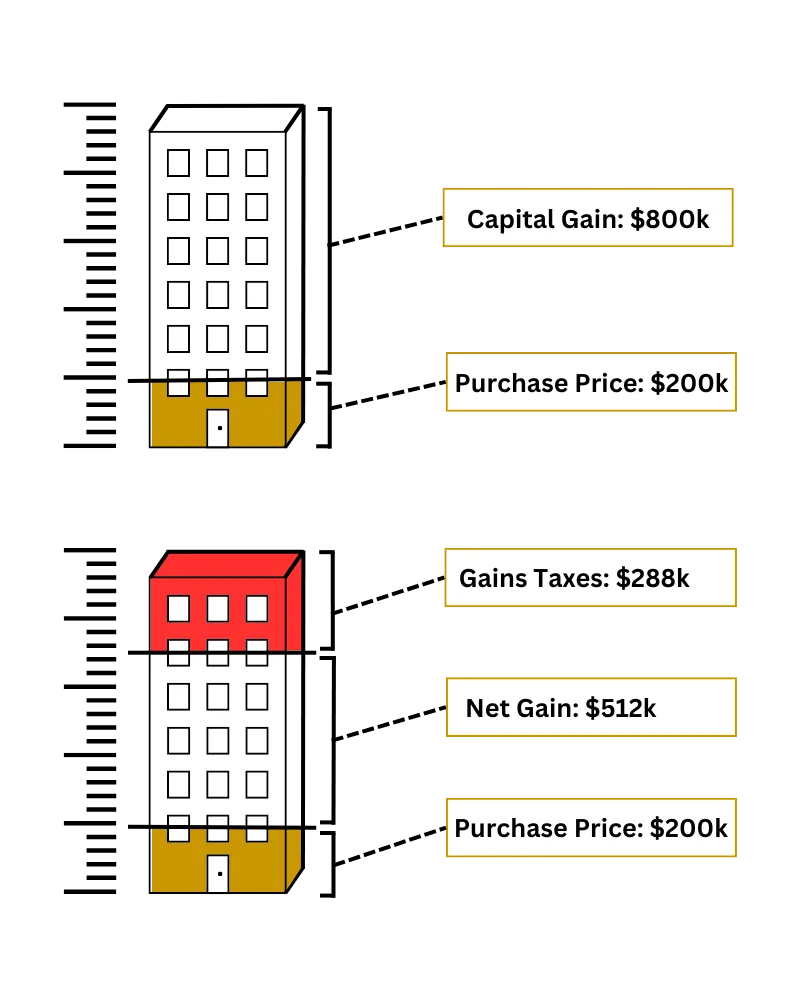

The sale of an investment asset can create a large tax liability. A properly structured tax-deferred exchange under Internal Revenue Code §1031 allows businesses and individuals to defer the recognition of capital gains and other taxes associated with the sale, as long as new assets are purchased to replace the relinquished assets. In general, most 1031 Exchanges are structured as real property (real estate) exchanges.

To benefit from a 1031 Exchange, the property must have been held by the client for productive use in a trade or business, or for investment purposes. The property must also be exchanged for a like-kind replacement property that will be held for similar purposes. With several restrictions, exchanges allow the sale and purchase of a property with no significant changes to the terms of the sale and purchase agreements.

By utilizing a 1031 Exchange, clients can maximize their capital by deferring the taxes that would otherwise be incurred on an outright sale of their property and use the entire amount of the equity from the 1031 Exchange to acquire substantially more replacement property. Properly structured, a 1031 Exchange becomes an invaluable tax savings and wealth preservation tool.

1031 Exchange Safety Nets

It's important to have a backup plan in case the 1031 Exchange fails. This is where an Installment Sale Trust (IST) can be incredibly beneficial. An IST allows you to defer taxes by spreading out the payment over several years, which can be especially useful if your exchange falls through or cannot be completed within the required timeframe. By setting up an Installment Sale Trust, you ensure that you still have a tax-deferral strategy in place, protecting your financial interests and providing flexibility in managing your assets.

1031 Exchange Timelines

A successful 1031 exchange hinges on strict adherence to IRS-mandated timelines. Once you sell your property, the clock starts ticking. You have exactly 45 days from the sale date to identify potential replacement properties. These properties must meet specific criteria, and you can identify up to three, regardless of their value, or more under certain rules. After that, you must close on one or more of these identified properties within 180 days from the sale of the original property. Missing either of these deadlines can disqualify your exchange, triggering immediate capital gains taxes. Proper planning and attention to these timelines are crucial to maximize the tax-deferral benefits offered by the 1031 exchange process.

1031 Exchange Boot

While a 1031 exchange allows you to defer capital gains taxes, any part of the sale proceeds that is not reinvested in the replacement property is considered "boot." Boot refers to any cash or other non-like-kind property you receive during the transaction. This can include money left over after the purchase of the new property or debt that was not replaced. The boot is taxable and will be subject to capital gains taxes, even if the majority of your transaction qualifies for tax deferral. Being aware of the boot is essential, as it can affect the overall tax outcome of your exchange. Proper planning with a qualified intermediary can help you minimize or avoid boot, ensuring a smoother transaction.

1031 Exchange Qualified Intermediary

A Qualified Intermediary is the mandatory partner in a 1031 exchange. The QI holds the cash after a sale to prevent constructive receipt (paying taxes).

When selecting a Qualified Intermediary to assist you in your next 1031 Exchange transaction, choose an accommodator that fits your needs, who offers the highest level of security, expertise, and service to their clients. There are many different types of exchanges available to investors, each with their own specific requirements and limitations. Having a knowledgeable partner and a backup strategy can make a significant difference in successfully managing your investments and maintaining tax deferral.

1031 Exchange 200% Rule

The 200% Rule is one of the identification options in a 1031 exchange that gives you flexibility when choosing replacement properties. Under this rule, you can identify any number of properties, as long as their combined fair market value does not exceed 200% of the value of the property you sold. This is particularly useful when you're looking at multiple smaller properties or if you want more flexibility in case one deal falls through. However, if the total value of identified properties exceeds 200% of the original property’s value, the exchange may be disqualified unless specific conditions are met. Careful consideration and adherence to this rule can ensure your exchange stays within IRS guidelines while giving you more options in your real estate investment strategy.

1031 Exchange 2-Year Rule

The 2-Year Rule applies to 1031 exchanges involving related parties, such as family members or entities where you have a substantial interest. If you exchange property with a related party, both you and the related party must hold the exchanged properties for at least two years after the exchange.

This rule is designed to prevent abuse of the 1031 exchange tax deferral by ensuring the transaction is not simply a way to shift properties within a controlled group. If either party sells or disposes of their property within this two-year period, the IRS may disqualify the exchange, triggering capital gains taxes on the original sale. Understanding the 2-Year Rule is critical for anyone considering an exchange with a related party.

What Doesn't Work for a 1031 Exchange

While 1031 exchanges offer significant tax deferral benefits, not all transactions or properties qualify. Personal-use properties, such as primary residences or vacation homes (unless they meet strict criteria), are not eligible for 1031 exchange treatment. Similarly, stocks, bonds, notes, partnership interests, and other securities do not qualify. In addition, "flipped" properties—those held primarily for resale rather than investment—are also excluded, as 1031 exchanges are designed for properties held for investment or productive use in a trade or business. Understanding what doesn’t qualify is crucial to avoid disqualification and unexpected tax liabilities.

Ready to Start your Tax-Deferral Journey?

Schedule a 15-minute phone call for further questions or getting started.

Nothing on this site should be interpreted to state or imply that past results are an indication of future performance. This site does not constitute a complete description of our investment services and is for informational purposes only. It is in no way a solicitation or an offer to sell insurance, annuities, securities or investment advisory services except, where applicable, in states where we are registered or where an exemption or exclusion from such registration or licensing exists. Information throughout this internet site, whether stock quotes, charts, articles, or any other statements regarding market or other financial information, is obtained from sources which we, and our suppliers believe reliable, but we do not warrant or guarantee the timeliness or accuracy of this information. Neither our information providers nor we shall be liable for any errors or inaccuracies, regardless of cause, or the lack of timeliness of, or for any delay or interruption in the transmission thereof to the user. All investments involve risk, including foreign currency exchange rates, political risks, different methods of accounting and financial reporting, and foreign taxes.